It is crucial for businesses to understand that carbon credits should not replace but complement other measures they take in the fight against climate change. Carbon credits are not a substitute for direct emissions reductions but an additional tool to support climate action and support their journey towards Net-Zero.

When it comes to using carbon credits International Carbon Registry (ICR) recommends that companies follow recognized standards such as ÍST 92:2022 and ISO 14068-1 providing guidance on carbon offsetting, neutrality and Net-Zero, helping businesses measure, reduce, and compensate for their emissions effectively.

Reducing emissions contributes to lower overall societal emissions, yet some emissions remain unavoidable in the short term and later residual emissions need to be dealt with. While companies work towards cutting emissions, carbon markets serve as a valuable tool to manage those that cannot be eliminated immediately.

Reducing emissions contributes to lower overall societal emissions. However, even as emissions are being reduced, some emissions will always remain, as it is not possible to eliminate all emissions immediately. The transition takes time, and we have a limited timeframe. Some climate actions are simple and inexpensive, while others are costly and complex to implement. This is where carbon markets come in.

Carbon markets can accelerate emission reductions beyond a company’s own value chain. This allows companies to take responsibility for emissions that cannot yet be eliminated in the short term by purchasing carbon credits—either through avoidance credits or, for long-term impact, through removal credits.

Carbon markets are a powerful tool for financing unviable climate actions. Carbon credits ensure transparency in how such funding is allocated, directly linking emissions to climate action.

Types of Carbon Credits

**Avoidance Carbon Credit **– A carbon credit that results from avoiding or reducing emissions, ensuring that less CO₂ is released into the atmosphere than would have otherwise occurred.

**Removal Carbon Credit **– A carbon credit that is generated by removing CO₂ from the atmosphere and storing it long-term in rock, soil, vegetation, or oceans.

Additionality

A key aspect of climate projects is that they must clearly demonstrate that emissions reductions would not have happened without the project. Each project issuing carbon credits is evaluated based on this criterion.

Key factors for additionality:

✅ The project must have a measurable climate benefit compared to a business-as-usual scenario.

✅ The project must not be implemented due to legal requirements.

✅ The project should not be common practice, such as using renewable energy in Iceland, unless it faces barriers like lack of financing, technical knowledge, or regulatory support.

Financial Additionality (e. financial additionality)

Financial additionality is assessed based on two factors:

1️⃣ Partially dependent on carbon markets – The project generates other revenues, but these are insufficient, and carbon credit sales are necessary to secure financing (e.g., renewable energy, composting).

2️⃣ Fully dependent on carbon markets – The project relies entirely on carbon credit sales for funding (e.g., afforestation, wetland restoration) as it has little or no other revenue sources.

A project may also be considered additional if it goes beyond government actions under the Paris Agreement or is not included in national emissions inventories, such as carbon sequestration in the ocean.

Different projects have varying levels of additionality, which is often reflected in carbon credit pricing. For example, nature-based solutions and carbon capture technologies are typically more expensive than renewable energy projects.

Projects can have varying levels of additionality, which is often reflected in the price of carbon credits (due to higher cost). For example, nature-based projects or technological solutions that capture and store carbon are generally more expensive than projects related to renewable energy, such as electricity generation or composting. ICR has developed a five-tier system to assess additionality levels across projects.

Pending or Active Carbon Credits

Carbon credits can either be pending (ex-ante) or active (ex-post). The key difference between them is that some are based on a validated future projection of performance, while others have been confirmed through monitoring, quantification and verification, ensuring that actual results have been achieved.

The distinction between pending and active credits does not imply a difference in quality; rather, it reflects how the credits are intended to be used and the purpose of the purchase. Only active credits can be retired.

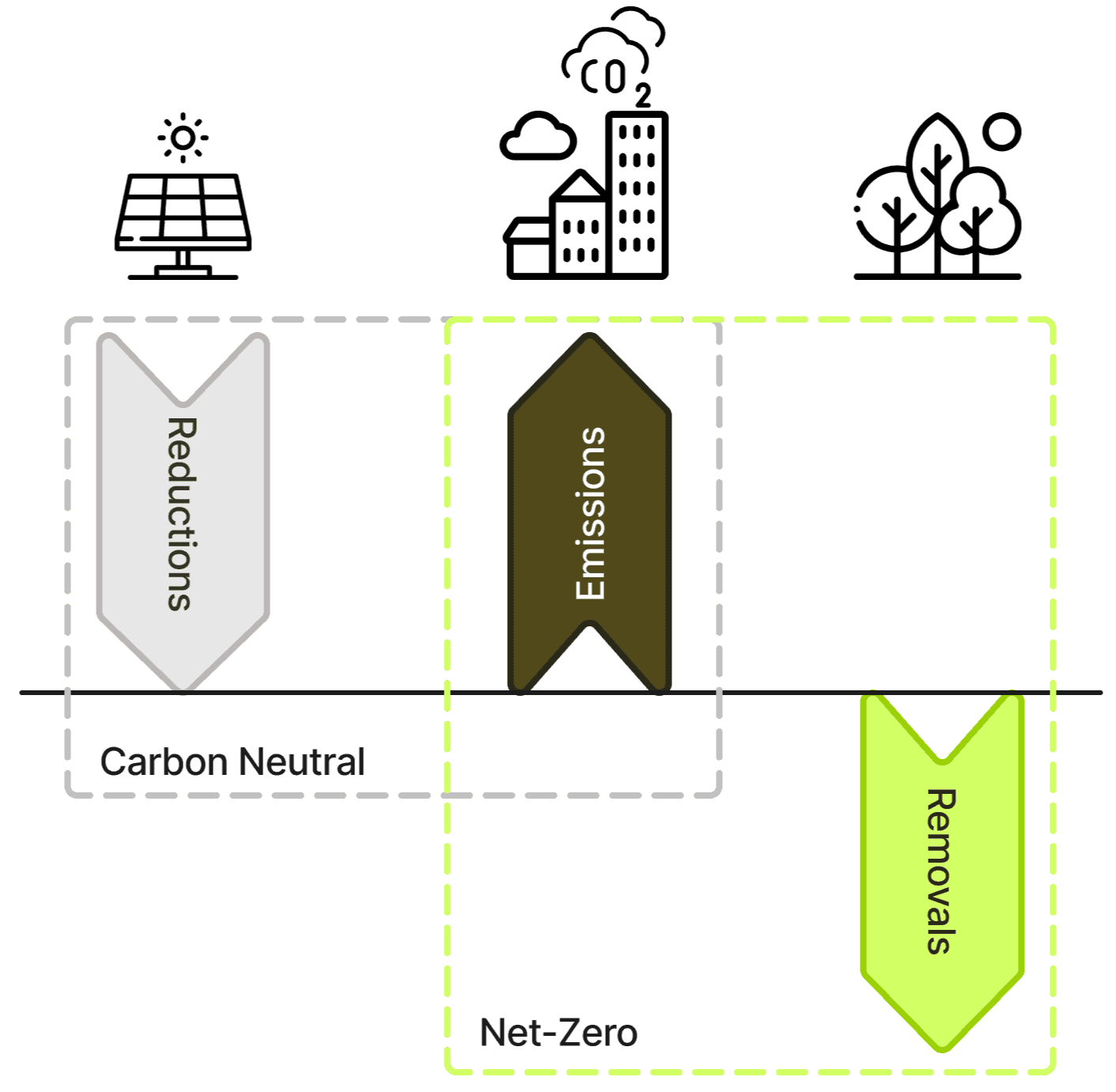

The world is on a journey toward achieving a balance between emissions and removals (Net-zero). However, we are still far from this goal. To reach it, significant reductions in emissions are necessary, while simultaneously increasing carbon sequestration. This means accelerating emission reduction efforts while also developing long-term projects that permanently remove or sequester carbon.

Strict rules govern the issuance of pending credits under ICR. Only projects that rely on carbon market financing are eligible for the issuance of pending or forward credits, and a maximum of 50% of the projected future impacts can be issued. Additionally, a portion of the credits is set aside in a buffer reserve, designed to compensate for shortfalls if projects fail to deliver the expected results.

Summary

Carbon credits support but do not replace emissions reductions. Businesses should follow recognized standards to ensure credibility. Carbon markets help manage unavoidable emissions and support external climate projects. Additionality ensures that carbon credits represent real climate benefits. Businesses can choose between avoidance and removal credits, with only verified active credits eligible for retirement. Achieving Net-Zero requires emission reductions alongside carbon sequestration, with carbon markets facilitating the transition.