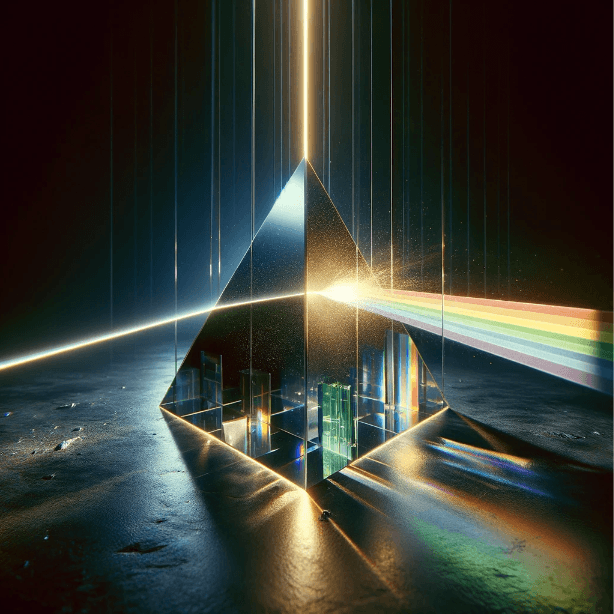

Shine on me crazy Carbon Credit

Examination of Carbon Credits from Multiple Angles

The world of carbon credits and trading, with its promise of fighting climate change acting as a bridge that transfers funds from polluters to initiatives aimed at reducing or removing greenhouse gases (GHGs) in a form of compensation or offsetting emissions. This dynamic closely mirrors the diamond trade, where the initial perception of perfection masks a complex reality. Just as diamonds undergo rigorous scrutiny to assess their true value and purity, carbon credits require a comprehensive evaluation to ensure their integrity in contributing to climate mitigation.

This article explores the multifaceted approach to validating climate projects and verifying carbon credits, comparing it to assessing a diamond's quality, to ensure they truly contribute to climate change mitigation and revealing high-quality carbon credits.

The lenses:

Standards and GHG Programs: The Foundation of Quality Assurance

Acting as the cornerstone of carbon credit quality, ISO GHG Standards and GHG (Greenhouse Gas) programs are akin to the 4Cs of diamonds, setting the stage for defining high-quality carbon credits. These frameworks foster market trust by establishing benchmarks for quality, transparency, sustainability, and additionality, enabling stakeholders to discern the true value of carbon credits as one would a diamond's quality.

Validation and Verification Bodies: The Gatekeepers of Integrity

Validation and verification bodies serve as the meticulous examiners of carbon credits, analogous to gemologists inspecting diamonds. They scrutinize the methodologies, project designs, and actual impacts of climate initiatives, ensuring that the carbon credits reflect genuine, quantifiable, and additional emission reductions or removals. Their critical role underpins the integrity and trust in the carbon market.

Accreditations: Ensuring Competence and Reliability

Accreditation bodies, members of the International Accreditation Forum (IAF), ensure validation and verification bodies (VVBs) operate with competence, impartiality, and professional skepticism. This accreditation guarantees that VVBs adhere to international standards, building trust among stakeholders and facilitating the global trade of carbon credits.

GHG program endorsements: The Guardians of Integrity

Adding to the complexity and integrity of the carbon credit market, independent parties play a critical role akin to the entities that certify the authenticity and ethical sourcing of diamonds. These organizations, including the International Carbon Reduction and Offsetting Alliance (ICROA), the Integrity Council for the Voluntary Carbon Market (ICVCM), and the Carbon Offsetting and Reduction Scheme for International Aviation (CORSIA), and Integrity Council of Voluntary Carbon Markets (ICVCM) serve as the guardians of GHG programs and carbon principles that ensure the credibility and environmental integrity of climate projects.

These bodies establish rigorous criteria and benchmarks that GHG programs need to meet to be recognized and endorsed. By doing so, ICROA, CORSIA and ICVCM provide yet another layer of assurance to buyers that the climate project supported and carbon credits they purchase truly contribute to mitigating climate change. These entities assess the adherence to established principles, providing best practice guidance on impacts, additionality, permanence, monitoring, avoidance of double counting, validation and verification among others.

Digital Monitoring and Reporting

The advancement of digital technologies in monitoring and reporting shines a modern light on climate projects and carbon credits, enhancing transparency and traceability. This aspect can be likened to the use of technology in mapping a diamond's inner characteristics and provenance. Digital tools allow for real-time, accurate tracking of emissions reductions or removals, ensuring that each carbon credit reflects a real impact.

Insurance and Ratings

Insurance and ratings introduce a financial and risk assessment layer, similar to the appraisal and insurance of diamonds. This sector evaluates the reliability and risk associated with carbon credits, offering a safeguard against investment in projects that do not meet promised climate benefits. Ratings provide a shorthand evaluation of a credit's integrity in addition to validation and verification, aiding investors and buyers in making informed decisions.

The Prismatic Value of Carbon Credits

Just as examining a diamond from multiple angles under different lights reveals its true beauty and value, scrutinizing carbon credits through the lenses of various stakeholders and processes ensures their effectiveness in combating climate change. This multidimensional evaluation is crucial in building trust and efficacy in the carbon market, ensuring that each credit contributes genuinely to fighting climate change. Like diamonds, carbon credits hold immense potential - but only if their value is authentically appraised and verified.

Find high quality carbon credits on www.carbonregistry.com